[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

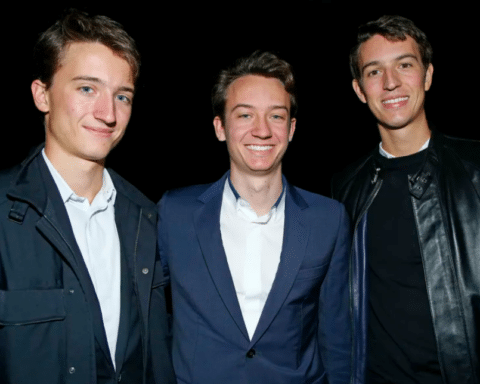

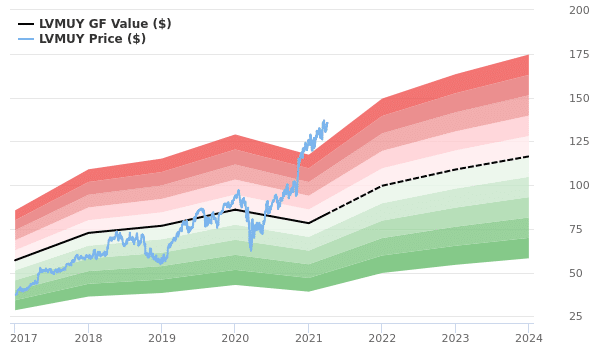

According to equity analyst GuruFocus, LVMH Moet Hennessy Louis Vuitton SE (LVMUY), listed on the Nasdaq US OTC Market, the US small-cap market, has every indication of being significantly overvalued. As a result, the long-term return on its stock is likely to be significantly lower than the future growth of its business, which has averaged 1.6% over the past three years and is expected to grow at 7.35% per year over the next three to five years.

As a reminder, the GuruFocus value is its estimate of the fair value at which the stock should trade. Its calculation is based on historical multiples at which the stock has traded, the company’s past growth and analysts’ estimates of the company’s future performance.

If a share price is excessively above the GF value line, it is overvalued and its future performance is likely to be poor. On the other hand, if it is significantly below the GF value line, its future return is likely to be higher.

With a current share price of $135.5 and a market capitalisation of $341.2 billion, LVMH Moet Hennessy Louis Vuitton SE is considered significantly overvalued.

In order to evaluate the investment of a LVMH share, GuruFocus bases itself on 3 factors: the financial strength of the company, its profitability, and its growth. According to GuruFocus, LVMH’s financial situation is good and its profitability is strong. Its growth is in line with the average of companies in the retail sector.

Fair financial strength

According to the analyst, investing in companies with poor financial strength carries a higher risk of permanent loss of capital. It is therefore essential to establish an accurate review of the financial strength of a company before deciding to buy its shares.

In order to analyse the financial strength of a company, a review of the cash/debt ratio and interest coverage is an excellent starting point.

LVMH has a cash to debt ratio of 0.55, which is about average for companies in the Cyclical Retail sector. GuruFocus rates LVMH’s overall financial strength at 5 out of 10, or fair.

Powerful profitability

The analysis goes on to say that it is less risky to invest in profitable companies, especially those that have demonstrated consistent profitability over the long term. A company with high profit margins is also generally a safer investment than one with low profit margins.

Over the past 10 years, LVMH has been profitable 10 times, and over the past 12 months, the company had revenues of $52.6 billion and earnings of $2.249 per share. Its operating margin is 18.59%, which is higher than 94% of companies in the cyclical retail sector.

GuruFocus therefore rates LVMH Moet Hennessy Louis Vuitton SE’s profitability as 8 out of 10, which is strong.

GuruFocus also shares another method for determining a company’s profitability. This compares its return on investment to the weighted average cost of capital.

Return on invested capital (ROIC) measures a company’s ability to generate cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it means that the company is creating value for shareholders.

Over the past 12 months, LVMH Moet Hennessy Louis Vuitton SE’s return on invested capital is 6.45, and its cost of capital is 4.84.

Average growth

Growth is probably the most important factor in the valuation of a company. The analyst’s research revealed the close proximity between growth and the long-term performance of a company’s shares. The faster a company grows, the more likely it is to create value for shareholders, especially if the growth is profitable.

With a 3-year average annual revenue growth rate of 1.6% and a 3-year average EBITDA growth rate of 9.1%, LVMH is in the middle of the pack among companies in the cyclical retail sector.

Read also > LVMH: THE SECRETS OF THIS REFUGE VALUE

Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

According to equity analyst GuruFocus, LVMH Moet Hennessy Louis Vuitton SE (LVMUY), listed on the Nasdaq US OTC Market, the US small-cap market, has every indication of being significantly overvalued. As a result, the long-term return on its stock is likely to be significantly lower than the future growth of its business, which has averaged 1.6% over the past three years and is expected to grow at 7.35% per year over the next three to five years.

As a reminder, the GuruFocus value is its estimate of the fair value at which the stock should trade. Its calculation is based on historical multiples at which the stock has traded, the company’s past growth and analysts’ estimates of the company’s future performance.

If a share price is excessively above the GF value line, it is overvalued and its future performance is likely to be poor. On the other hand, if it is significantly below the GF value line, its future return is likely to be higher.

With a current share price of $135.5 and a market capitalisation of $341.2 billion, LVMH Moet Hennessy Louis Vuitton SE is considered significantly overvalued.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

According to equity analyst GuruFocus, LVMH Moet Hennessy Louis Vuitton SE (LVMUY), listed on the Nasdaq US OTC Market, the US small-cap market, has every indication of being significantly overvalued. As a result, the long-term return on its stock is likely to be significantly lower than the future growth of its business, which has averaged 1.6% over the past three years and is expected to grow at 7.35% per year over the next three to five years.

As a reminder, the GuruFocus value is its estimate of the fair value at which the stock should trade. Its calculation is based on historical multiples at which the stock has traded, the company’s past growth and analysts’ estimates of the company’s future performance.

If a share price is excessively above the GF value line, it is overvalued and its future performance is likely to be poor. On the other hand, if it is significantly below the GF value line, its future return is likely to be higher.

With a current share price of $135.5 and a market capitalisation of $341.2 billion, LVMH Moet Hennessy Louis Vuitton SE is considered significantly overvalued.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Press[/vc_column_text][/vc_column][/vc_row][vc_column][/vc_column]