Last July, Kering and Mayhoola announced a strategic agreement that would see François-Henri Pinault’s group acquire a stake in Valentino, owned by the Qatari investment fund. At the beginning of October, Mayhoola’s CEO gave further details of the alliance in an interview with WWD.

The announcement came as a bombshell. Last July, the luxury goods group Kering (owner of Gucci and Balenciaga) and the Qatari investment company Mayhoola (owner of Valentino and Balmain) announced that they had reached an agreement.

The agreement will enable Kering to acquire a 30% stake in Valentino, which Mayhoola acquired in 2012 for €756 million. Kering will even be able to purchase 100% of the House until 2028. This will open up new perspectives for Valentino, whose CEO Jacopo Venturini, together with Mayhoola, has established a strategy of elevation to make it one of the most admired luxury Houses in the world.

Valentino’s future at stake

Read also > STOCK MARKET : THE LUXURY SECTOR FACES SEVERE TURBULENCES

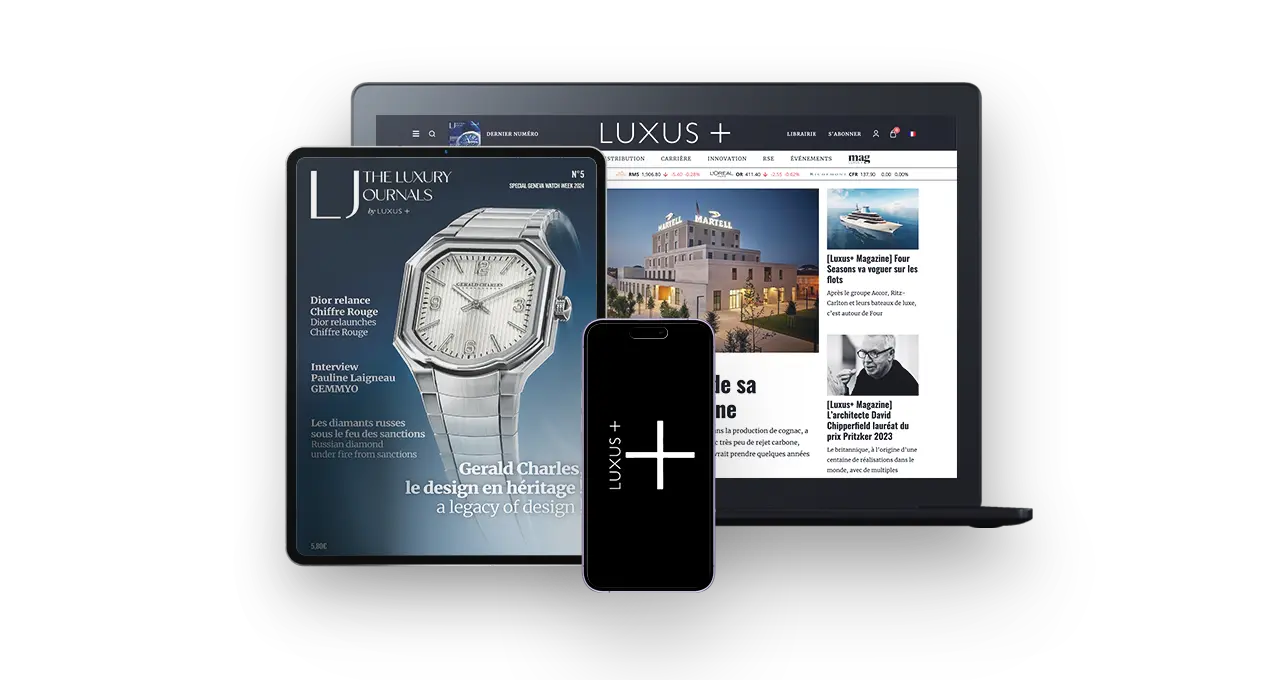

Featured photo : © Press