[vc_row njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

In a survey carried out at the beginning of November and published on Monday 7 December 2020, the Cetelem Observatory focused on the issue of social and environmental responsibility in the luxury sector, highlighted by the current pandemic.

Created in 1985, the Cetelem Observatory is an economic research and monitoring structure of the BNP Paribas Personal Finance Group, headed by Flavien Neuvy. Every year, this organisation conducts three series of surveys – the zOOms – on a variety of social issues. In October 2020, the Cetelem Observatory conducted its first statistical study of the luxury industry, which was completed a month later by a survey of the French on the subject of responsibility in the luxury sector. On 7 December last, this report was the subject of a press release by Arthur Vandenkerckhove, a consultant for the Rumeur Publique agency.

According to the results of this second wave of surveys, less than half of the French (42%) consider that the luxury industry is heavily penalised by the health crisis. Nearly three out of four French people (73%) would even consider that the crisis represents an opportunity for the sector to accentuate its initiatives in favour of sustainable development and the environmental and social values it implies.

This change in the aspirations of the French, who are increasingly concerned about corporate social and environmental responsibility (CSR), has been reinforced by what the Cetelem Observatory study calls a “containment effect”. Forced to stay at home and enjoy only the “little luxuries” of everyday life (reading, cooking, etc.), 78% of the French people questioned actually perceive luxury products as “superfluous” goods. Only one French person in five (22%) would see luxury as a way to overcome the difficulties imposed by the health crisis.

Although it is considered to be out of touch with current realities, the luxury sector would have been able to adapt to modernity, notably through new technologies according to 90% of the sample considered. While the luxury industry seems to have effectively responded to an increasing demand on line or for second-hand goods (84%), the French are less unanimous (75%) about its capacity to adapt in terms of respect for the environment, animals or local production.

More specifically, just over a third (35%) of the French believe that the luxury sector is currently committed to a sustainable development approach. Ranked last out of a total of nine economic sectors, the luxury industry is far behind the textile (52%) and entertainment (48%) sectors and is slightly surpassed by the air transport sector (36%).

Paradoxically, 89% of the French – and 94% of those already consuming luxury goods – believe that the sector has a duty to be exemplary in terms of social and environmental responsibility. If the results relating to the level of commitment of the luxury industry are so low, it is because it is the subject of a certain scepticism on the part of the population concerned by the study. Indeed, more than two thirds (68%) of the French people surveyed consider the commitment of luxury brands as an integral part of their communication strategy. Only 32% of the French would therefore believe in a “sincere” approach. This mistrust is slightly higher among the oldest (72% among those aged 65 and over) and those who do not consume luxury goods, or rarely (76%).

Because its consumers are more and more attentive to the steps taken in favour of eco-responsible development, the luxury industry would therefore be well advised to become part of a circular economy. Indeed, 55% of the French declare that they aspire to consumption patterns that favour reuse rather than additional production, a trend that is amplified among young people (73%) and those under 35 (50%).

These more virtuous forms of trade would therefore be an opportunity for the luxury industry to be seen by the French people as part of more responsible policies. And for good reason: for nearly half of them (47%), luxury embodies the idea of consuming less while consuming better. Several other qualities of the luxury industry are also recognized by the French: 64% think, for example, that products of French luxury brands are made more on the national territory, 57% think that the sector is more respectful of animals and 55% think that the local workforce is better considered there than in other sectors.

All in all, while the luxury industry still has a lot of room for improvement in the area of sustainable development, it can boast a loyal clientele that is optimistic about its resilience. For example, 64% of French luxury goods consumers surveyed said they are willing to buy to support the sector, although a large majority of the population surveyed (89%) trust it to bounce back after the crisis. 38% of French people do indeed perceive luxury products as safe investments.

Nevertheless, this loyalty of luxury consumers translates into paradoxical positions that complicate the insertion of the sector in a circular economy. Thus, while nearly one French person in five (19%) declares having already bought a second-hand luxury product and 7% having already rented one, French people already consuming luxury goods declare that they prefer new products (58%). Moreover, 67% of the people considered in the Observatory survey would prefer to buy in stores rather than online. This registration of transactions in more traditional sales channels attests to the ambiguity of the luxury sector, whose need to adapt to current socio-economic developments should not mask its very particular identity.

Read also > FENDI STRENGTHENS ITS COMMITMENT TO SOCIAL AND ENVIRONMENTAL RESPONSIBILITY SWITZERLAND

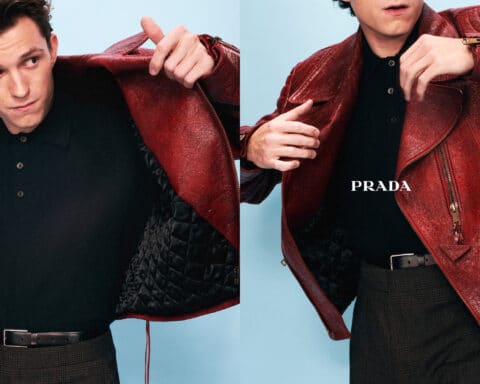

Featured Photo : © Presse[/vc_column_text][/vc_column][/vc_row]