[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

Bernard Arnault, the CEO of LVMH, bought shares for a total of 270 million euros, further increasing the family’s capital in the luxury group. Analysts are positive about the share price, which has only increased over the years.

Bernard Arnault wants to strengthen the position of his family within the luxury group he leads. According to statements made to the Autorité des marchés financiers, the LVMH boss bought 335,322 shares in the group between January 27 and February 28 at prices ranging from 788 to 823 euros. These shares were acquired through the companies Christian Dior, 97.5% controlled by the Arnault family, and Financière Agache, the parent company of Christian Dior.

In December 2022, the Arnault family already owned 48.18% of LVMH shares, compared with 47.83% in 2021. Also in December 2022, it held 63.90% of the voting rights, a slight increase compared to the end of 2021.

The total number of shareholders in the company is estimated to be close to 300,000. Among them, the share of foreign institutional investors is estimated at 38.7% of the company’s shares, while French institutional investors hold 7.8%. LVMH employees own less than 0.5% of the shares.

Positive estimates

In terms of stock market attractiveness, LVMH stock has received a score of 5.3 out of 10 from Equity GPS, a system that re-evaluates stock valuations every day. The luxury group has a valuation ratio score of 1.4 out of 10 and an earnings outlook score of 9.1 out of 10.

Similarly, analysts at Factset, a multinational financial data management company, have positive recommendations with an average price target of 880 euros. Of the thirty-one financial analysts referenced, twenty-six are positive, five are “hold”. Among them, Thierry Cota of Société Générale is the most optimistic and targets a price of 920 euros. Graham Renwick of Berenberg, more reserved, believes that the share price should be around 710 euros.

The share price has risen by 29% in one year, 115% in three years, 232% in five years and 516% in ten years (excluding dividends).

Different share buyback strategy

Five days ago, the group had announced its new share buyback program, to be carried out between March 1 and July 20, 2023.

“As part of its share buyback program, LVMH Moët Hennessy Louis Vuitton S.E. (LVMH) has today entrusted an investment services provider with a mandate to acquire its own shares for a maximum amount of one billion five hundred million euros”, the group explained in a statement.

However, it is important to differentiate between the two share buybacks. In the context of the buyback by LVMH, the French luxury group wishes to cancel these shares. The goal is easily identifiable: this operation is often win-win for the company and its shareholders, since it mechanically increases the company’s earnings per share (EPS). Also, the announcement of these buyback programs is well received by the markets, because companies often offer shareholders a buyback price higher than the last closing price of the share.

In this case, it is a personal initiative of Bernard Arnault, and no cancellation has been specified. The shares will therefore be directly attached to the capital of the Arnault family, a way to secure the place of its members and to prepare the succession of the 74 year old billionaire.

Read also >Donation of a painting by Caillebotte : what benefit for LVMH ?

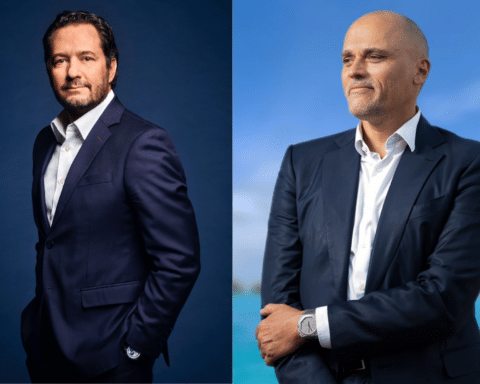

Featured photo : © DR[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Bernard Arnault, the CEO of LVMH, bought shares for a total of 270 million euros, further increasing the family’s capital in the luxury group. Analysts are positive about the share price, which has only increased over the years.

Bernard Arnault wants to strengthen the position of his family within the luxury group he leads. According to statements made to the Autorité des marchés financiers, the LVMH boss bought 335,322 shares in the group between January 27 and February 28 at prices ranging from 788 to 823 euros. These shares were acquired through the companies Christian Dior, 97.5% controlled by the Arnault family, and Financière Agache, the parent company of Christian Dior.

In December 2022, the Arnault family already owned 48.18% of LVMH shares, compared with 47.83% in 2021. Also in December 2022, it held 63.90% of the voting rights, a slight increase compared to the end of 2021.

The total number of shareholders in the company is estimated to be close to 300,000. Among them, the share of foreign institutional investors is estimated at 38.7% of the company’s shares, while French institutional investors hold 7.8%. LVMH employees own less than 0.5% of the shares.

Positive estimates

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © DR[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

Bernard Arnault, the CEO of LVMH, bought shares for a total of 270 million euros, further increasing the family’s capital in the luxury group. Analysts are positive about the share price, which has only increased over the years.

Bernard Arnault wants to strengthen the position of his family within the luxury group he leads. According to statements made to the Autorité des marchés financiers, the LVMH boss bought 335,322 shares in the group between January 27 and February 28 at prices ranging from 788 to 823 euros. These shares were acquired through the companies Christian Dior, 97.5% controlled by the Arnault family, and Financière Agache, the parent company of Christian Dior.

In December 2022, the Arnault family already owned 48.18% of LVMH shares, compared with 47.83% in 2021. Also in December 2022, it held 63.90% of the voting rights, a slight increase compared to the end of 2021.

The total number of shareholders in the company is estimated to be close to 300,000. Among them, the share of foreign institutional investors is estimated at 38.7% of the company’s shares, while French institutional investors hold 7.8%. LVMH employees own less than 0.5% of the shares.

Positive estimates

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.[/vc_cta][vc_column_text]Featured photo : © DR[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]