[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

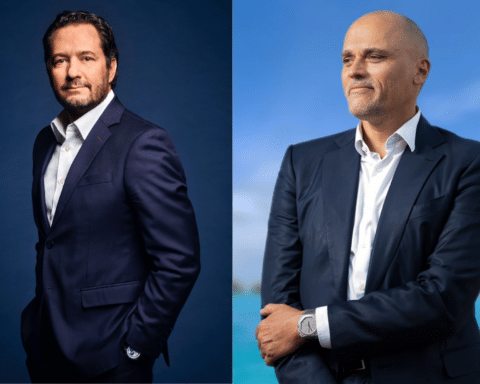

Kering, the French luxury goods group, announced on Monday the signing of an agreement to acquire 100% of the Creed fragrance brand from funds controlled by asset manager BlackRock and Javier Ferrán, the company’s current president.

On Monday, luxury goods group Kering, owner of prestigious brands such as Gucci, Saint Laurent and Bottega Veneta, announced its intention to acquire English “haute parfumerie” company Creed, based in London and Paris.

Creed is renowned for its exclusive fragrances, handcrafted in Fontainebleau and distributed worldwide. This acquisition is designed to accelerate the development of Kering and its Beauty division, particularly in the Chinese market.

Kering has confirmed that it has signed an agreement to acquire 100% of Creed. The funds held by asset manager BlackRock and Javier Ferrán, current Chairman of Creed, have agreed to sell their shares. The cash transaction is expected to close in the second half of 2023, subject to approval by the relevant competition authorities.

“The acquisition of Creed, which is Kering Beauté’s first strategic initiative, demonstrates our ambition to build for the Group a solid position in the most exclusive segment of this category”, said François-Henri Pinault, CEO of Kering.

A successful perfume brand

The Haute Parfumerie segment is experiencing strong market momentum, with double-digit growth, high profitability and consistent performance giving it long-term resilience.

The Maison Creed, founded in 1760 by James Henry Creed, will record “sales of around 250 million euros in 2023 in the very favorable haute parfumerie market”, said Raffaella Cornaggia, CEO of Kering Beauté, during a conference call with the press.

The independent company is considered “a real nugget in the booming haute parfumerie sector, thanks to its high profitability”, she added.

“Creed’s positioning in the haute parfumerie market is unique, and this transaction presents clear fundamentals and mutual benefits in terms of expertise, distribution network and geographic presence”, added Raffaella Cornaggia. “We look forward to working with Managing Director Sarah Rotheram and her passionate team to continue building Creed’s success worldwide.”

In its network of 36 stores, mainly in Europe and the USA, Creed offers its customers a unique, made-to-measure experience. The brand is also distributed through a network of around 1,400 points of sale worldwide.

Read also >Kering inaugurates its new Italian headquarters in central Milan

Featured photo : © Lore Perfumery[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Kering, the French luxury goods group, announced on Monday the signing of an agreement to acquire 100% of the Creed fragrance brand from funds controlled by asset manager BlackRock and Javier Ferrán, the company’s current president.

On Monday, luxury goods group Kering, owner of prestigious brands such as Gucci, Saint Laurent and Bottega Veneta, announced its intention to acquire English “haute parfumerie” company Creed, based in London and Paris.

Creed is renowned for its exclusive fragrances, handcrafted in Fontainebleau and distributed worldwide. This acquisition is designed to accelerate the development of Kering and its Beauty division, particularly in the Chinese market.

Kering has confirmed that it has signed an agreement to acquire 100% of Creed. The funds held by asset manager BlackRock and Javier Ferrán, current Chairman of Creed, have agreed to sell their shares. The cash transaction is expected to close in the second half of 2023, subject to approval by the relevant competition authorities.

“The acquisition of Creed, which is Kering Beauté’s first strategic initiative, demonstrates our ambition to build for the Group a solid position in the most exclusive segment of this category”, said François-Henri Pinault, CEO of Kering.

A successful perfume brand

The Haute Parfumerie segment is experiencing strong market momentum, with double-digit growth, high profitability and consistent performance giving it long-term resilience.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Lore Perfumery[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

Kering, the French luxury goods group, announced on Monday the signing of an agreement to acquire 100% of the Creed fragrance brand from funds controlled by asset manager BlackRock and Javier Ferrán, the company’s current president.

On Monday, luxury goods group Kering, owner of prestigious brands such as Gucci, Saint Laurent and Bottega Veneta, announced its intention to acquire English “haute parfumerie” company Creed, based in London and Paris.

Creed is renowned for its exclusive fragrances, handcrafted in Fontainebleau and distributed worldwide. This acquisition is designed to accelerate the development of Kering and its Beauty division, particularly in the Chinese market.

Kering has confirmed that it has signed an agreement to acquire 100% of Creed. The funds held by asset manager BlackRock and Javier Ferrán, current Chairman of Creed, have agreed to sell their shares. The cash transaction is expected to close in the second half of 2023, subject to approval by the relevant competition authorities.

“The acquisition of Creed, which is Kering Beauté’s first strategic initiative, demonstrates our ambition to build for the Group a solid position in the most exclusive segment of this category”, said François-Henri Pinault, CEO of Kering.

A successful perfume brand

The Haute Parfumerie segment is experiencing strong market momentum, with double-digit growth, high profitability and consistent performance giving it long-term resilience.

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Lore Perfumery[/vc_column_text][/vc_column][/vc_row]