[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

The beauty specialist Coty has announced that it is considering a listing on the Paris stock exchange, in addition to the New York one. A decision that makes sense, while the Franco-American group, born in the French capital, has been improving its results for two years.

A second wind for Coty? The Franco-American beauty products company, said Friday that it was studying the possibility of a second listing on the Paris Stock Exchange, in addition to the New York Stock Exchange (NYSE). The group hopes to attract new investors and strengthen its presence in Europe, especially for its CoverGirl brand.

Also known for its perfume brands such as Hugo Boss, Gucci and Burberry, Coty had confirmed in March its annual profit forecast. That is, the projection of like-for-like sales growth for the year, at the top end of its previous forecast range of 6 to 8%.

The company is expected to announce the results of its third fiscal quarter next week, after its competitor Estée Lauder. The latter is anticipating poor numbers due to a weak recovery in duty-free and travel destinations, particularly in Asia.

Back to the roots

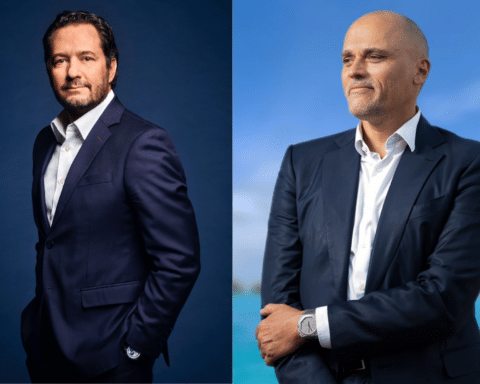

“Paris is the historic cradle of beauty and the sector still has a particular appeal to investors. The board’s interest in considering a possible listing on the Paris Stock Exchange was made possible by the progress Coty has made” under the leadership of CEO Sue Nabi, said Peter Harf, the group’s chairman, quoted in a statement.

It should also be remembered that Paris is the historical birthplace of the group, founded in 1904. In the capital, François Coty is then a visionary and controversial perfumer. He owned the Figaro for a while before launching the far-right daily L’Ami du Peuple. The group then expanded rapidly across the Atlantic and set up its headquarters in the United States, shortly before the death of its founder in 1934. In 1963, the group was acquired by Pfizer, then sold thirty years later to JAB Holding. In 2013, JAB Holding floated Coty on the stock market and currently holds 53% of the capital, as the reference shareholder.

Company in redemption

The American cosmetics group, which has released $5.3 billion (€4.8 billion) in revenue in 2022, has not always been in good health. When Sue Nabi took the reins in 2020, the company was then indebted to a series of acquisitions, unstable management and heavy losses.

The company’s leader has accelerated the move upmarket, with a prestige division achieving an Ebitda margin of 21%, while consumer beauty products settle for 12%. The group has also focused on online retail, developing skin care and hopes to double its sales in China to more than $600 million. Satisfied with the turnaround, JAB Holding announced Friday that it was extending the CEO’s tenure through 2030.

Coty’s stock has risen 38% since the beginning of the year in New York and is now paying 32 times its expected net profit. However, it is still trading at a lower price than five years ago.

If it were to join Euronext Paris, Coty, which is worth $10 billion on the stock market, would be far behind L’Oreal. The French cosmetics giant pays 35 times its profits and is worth 226 billion euros on the stock market!

Read also >Coty extends its licensing agreement with Jil Sander

Featured photo : © Coty[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

The beauty specialist Coty has announced that it is considering a listing on the Paris stock exchange, in addition to the New York one. A decision that makes sense, while the Franco-American group, born in the French capital, has been improving its results for two years.

A second wind for Coty? The Franco-American beauty products company, said Friday that it was studying the possibility of a second listing on the Paris Stock Exchange, in addition to the New York Stock Exchange (NYSE). The group hopes to attract new investors and strengthen its presence in Europe, especially for its CoverGirl brand.

Also known for its perfume brands such as Hugo Boss, Gucci and Burberry, Coty had confirmed in March its annual profit forecast. That is, the projection of like-for-like sales growth for the year, at the top end of its previous forecast range of 6 to 8%.

The company is expected to announce the results of its third fiscal quarter next week, after its competitor Estée Lauder. The latter is anticipating poor numbers due to a weak recovery in duty-free and travel destinations, particularly in Asia.

Back to the roots

“Paris is the historic cradle of beauty and the sector still has a particular appeal to investors. The board’s interest in considering a possible listing on the Paris Stock Exchange was made possible by the progress Coty has made” under the leadership of CEO Sue Nabi, said Peter Harf, the group’s chairman, quoted in a statement.

It should also be remembered that Paris is the historical birthplace of the group, founded in 1904. In the capital, François Coty is then a visionary and controversial perfumer. He owned the Figaro for a while before launching the far-right daily L’Ami du Peuple. The group then expanded rapidly across the Atlantic and set up its headquarters in the United States, shortly before the death of its founder in 1934. In 1963, the group was acquired by Pfizer, then sold thirty years later to JAB Holding. In 2013, JAB Holding floated Coty on the stock market and currently holds 53% of the capital, as the reference shareholder.

Company in redemption

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Coty[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

The beauty specialist Coty has announced that it is considering a listing on the Paris stock exchange, in addition to the New York one. A decision that makes sense, while the Franco-American group, born in the French capital, has been improving its results for two years.

A second wind for Coty? The Franco-American beauty products company, said Friday that it was studying the possibility of a second listing on the Paris Stock Exchange, in addition to the New York Stock Exchange (NYSE). The group hopes to attract new investors and strengthen its presence in Europe, especially for its CoverGirl brand.

Also known for its perfume brands such as Hugo Boss, Gucci and Burberry, Coty had confirmed in March its annual profit forecast. That is, the projection of like-for-like sales growth for the year, at the top end of its previous forecast range of 6 to 8%.

The company is expected to announce the results of its third fiscal quarter next week, after its competitor Estée Lauder. The latter is anticipating poor numbers due to a weak recovery in duty-free and travel destinations, particularly in Asia.

Back to the roots

“Paris is the historic cradle of beauty and the sector still has a particular appeal to investors. The board’s interest in considering a possible listing on the Paris Stock Exchange was made possible by the progress Coty has made” under the leadership of CEO Sue Nabi, said Peter Harf, the group’s chairman, quoted in a statement.

It should also be remembered that Paris is the historical birthplace of the group, founded in 1904. In the capital, François Coty is then a visionary and controversial perfumer. He owned the Figaro for a while before launching the far-right daily L’Ami du Peuple. The group then expanded rapidly across the Atlantic and set up its headquarters in the United States, shortly before the death of its founder in 1934. In 1963, the group was acquired by Pfizer, then sold thirty years later to JAB Holding. In 2013, JAB Holding floated Coty on the stock market and currently holds 53% of the capital, as the reference shareholder.

Company in redemption

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Coty[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]