[vc_row njt-role-user-roles=”administrator,armember”][vc_column][vc_column_text]

The stock markets have already noted the economic risks associated with the new health measures, which are having a strong impact on the markets in Europe and the United States. On Wall Street, it’s a black Wednesday for the Dow Jones index, which plunged more than 3%.

For most European markets, yesterday was a day of sharp decline. At the close this Wednesday, the CAC 40 fell 3.37% to 4,571.12 points, its worst session in more than a month. After dropping below -4%, the index recovered slightly for the last hour. The German Dax ended its session with a worrying drop of 4.17%, while London lost 2.55%.

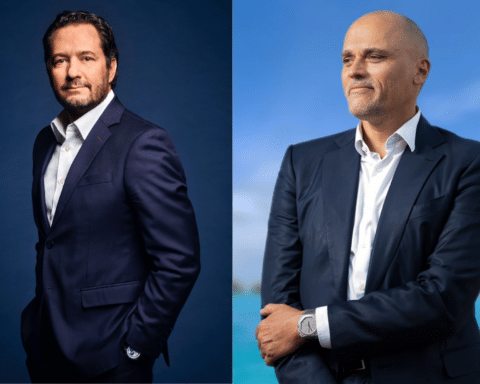

“All the indicators are in the red: the American presidential election is inducing its usual renewed risk aversion, the economic figures are generally bad, except in Asia, and above all the reconfinement at work in Europe is causing fears for the economic recovery,” explains Christopher Dembik, head of economic research at Saxo Bank.

“Under these circumstances, the pressure will increase on the ECB to take new support measures, but objectively, it is difficult to see what effective weapon it could draw in the face of the pandemic,” continues the expert.

The President of the European Central Bank, Christine Lagarde, will preside over her eighth monetary policy meeting at the ECB this Thursday, which is eagerly awaited by the various European economic players.

The fears are not limited to Europe, and in the United States, the anxieties are similar. On D-6 of the American presidential election, which will take place on November 3, the New York Stock Exchange is also in the red as soon as it opens. The various American investors are particularly worried about the economic impact of the increase in positive COVID-19 cases, which can be observed just about everywhere in the world.

The country’s main index, the Dow Jones Industrial Average, which was approaching its lowest level in more than a month, plunged 3.43% to 26,520.97 points, according to provisional results at the close this Wednesday. At the same time, the Nasdaq fell 3.73% to 11,004.86 points and the S&P 500 Expanded Index fell 3.53% to 3,271.03 points, their biggest drop since June.

While new, stricter measures are taking shape throughout Europe, investors are concerned about the consequences of these measures on the economic recovery, which already seems to be in jeopardy. For its part, Italy is experiencing its worst economic recession since the Second World War this year, and the country has been shaken by numerous protests against the new measures for several days. The protesters are opposed to the decisions taken by their government, and denounce the fact that these measures limit the activity of certain professional categories.

Fearured photo : © Press[/vc_column_text][/vc_column][/vc_row]