[vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”administrator,editor,author,armember”][vc_column][vc_column_text]

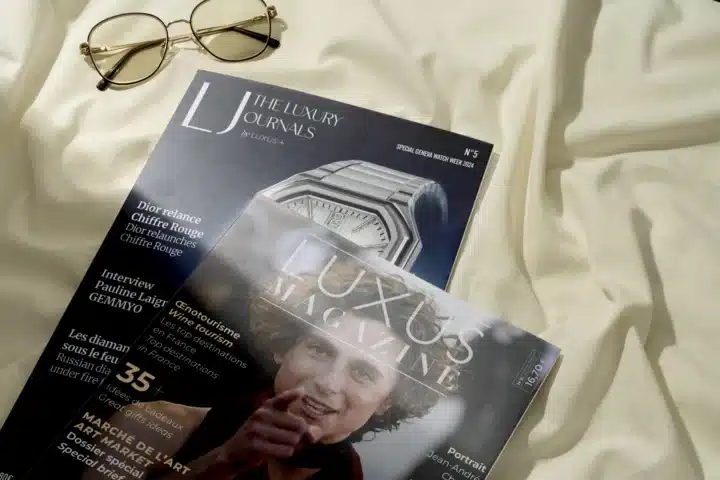

Swiss watch exports fell slightly in July, the first monthly decline in over two years. The last decline was in December 2021. However, the federation said the slight slowdown “will not have a significant impact on the overall trend or forecasts for 2023”, suggesting that the industry could still reach a record this year.

Swiss watch exports recorded a slowdown in July, following a period of sustained growth at the start of the year, according to the watchmaking federation on August 22. Although slightly down (-0.9%) on July 2022, they still reached 2.2 billion Swiss francs (2.3 billion euros). The watchmaking federation explains that this monthly variation, linked to a “negative base effect in China and Singapore” and the contraction of steel watch exports (-6.1%), has no significant impact on the general trend or on forecasts for 2023.

According to the federation, the main markets experienced a slowdown or decline in growth in July. For example, exports to China, the world’s second-largest market for Swiss watches, fell by 16.6%. Sales also fell in Singapore (-7.1%), France (-14.2%), Italy (-9.7%) and South Korea (-24.1%), impacting monthly results. On the other hand, exports increased to the USA (+5.2%), the leading foreign market, as well as to Hong Kong (+6.3%), Japan (+5.9%) and the UK (+5.6%), which remains the most important European market for Swiss watches.

Widespread decline

After breaking records in 2021 and 2022, the Swiss watch industry had maintained vigorous growth in the first half of the year, with an increase of 11.8%.

However, statistics published by the Federal Customs Office revealed that in July, the country’s total exports in all categories fell by 5.7% (without adjusting for inflation) on the previous month, reaching its lowest level since the start of the year.

With the exception of foodstuffs, beverages and tobacco, all the main sectors recorded a fall in exports in July 2023. Among them, chemicals and pharmaceuticals had the greatest impact on the overall result. Exports fell particularly sharply to the USA and Asia.

However, Swiss foreign trade also fell in import terms in July, resulting in a trade surplus of 2.6 billion Swiss francs (2.7 billion euros).

Featured photo : © Omega Watches [/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”not-logged-in”][vc_column][vc_column_text]

Swiss watch exports fell slightly in July, the first monthly decline in over two years. The last decline was in December 2021. However, the federation said the slight slowdown “will not have a significant impact on the overall trend or forecasts for 2023”, suggesting that the industry could still reach a record this year.

Swiss watch exports recorded a slowdown in July, following a period of sustained growth at the start of the year, according to the watchmaking federation on August 22. Although slightly down (-0.9%) on July 2022, they still reached 2.2 billion Swiss francs (2.3 billion euros). The watchmaking federation explains that this monthly variation, linked to a “negative base effect in China and Singapore” and the contraction of steel watch exports (-6.1%), has no significant impact on the general trend or on forecasts for 2023.

According to the federation, the main markets experienced a slowdown or decline in growth in July. For example, exports to China, the world’s second-largest market for Swiss watches, fell by 16.6%. Sales also fell in Singapore (-7.1%), France (-14.2%), Italy (-9.7%) and South Korea (-24.1%), impacting monthly results. On the other hand, exports increased to the USA (+5.2%), the leading foreign market, as well as to Hong Kong (+6.3%), Japan (+5.9%) and the UK (+5.6%), which remains the most important European market for Swiss watches.

Widespread decline

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Omega Watches[/vc_column_text][/vc_column][/vc_row][vc_row njt-role=”people-in-the-roles” njt-role-user-roles=”subscriber,customer”][vc_column][vc_column_text]

Swiss watch exports fell slightly in July, the first monthly decline in over two years. The last decline was in December 2021. However, the federation said the slight slowdown “will not have a significant impact on the overall trend or forecasts for 2023”, suggesting that the industry could still reach a record this year.

Swiss watch exports recorded a slowdown in July, following a period of sustained growth at the start of the year, according to the watchmaking federation on August 22. Although slightly down (-0.9%) on July 2022, they still reached 2.2 billion Swiss francs (2.3 billion euros). The watchmaking federation explains that this monthly variation, linked to a “negative base effect in China and Singapore” and the contraction of steel watch exports (-6.1%), has no significant impact on the general trend or on forecasts for 2023.

According to the federation, the main markets experienced a slowdown or decline in growth in July. For example, exports to China, the world’s second-largest market for Swiss watches, fell by 16.6%. Sales also fell in Singapore (-7.1%), France (-14.2%), Italy (-9.7%) and South Korea (-24.1%), impacting monthly results. On the other hand, exports increased to the USA (+5.2%), the leading foreign market, as well as to Hong Kong (+6.3%), Japan (+5.9%) and the UK (+5.6%), which remains the most important European market for Swiss watches.

Widespread decline

[…][/vc_column_text][vc_cta h2=”This article is reserved for subscribers.” h2_font_container=”tag:h2|font_size:16|text_align:left” h2_use_theme_fonts=”yes” h4=”Subscribe now !” h4_font_container=”tag:h2|font_size:32|text_align:left|line_height:bas” h4_use_theme_fonts=”yes” txt_align=”center” color=”black” add_button=”right” btn_title=”I SUBSCRIBE !” btn_color=”danger” btn_size=”lg” btn_align=”center” use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_button_block=”true” btn_custom_onclick=”true” btn_link=”url:https%3A%2F%2Fluxus-plus.com%2Fen%2Fsubscriptions-and-newsletter-special-offer-valid-until-september-30-2020-2-2%2F”]Get unlimited access to all articles and live a new reading experience, preview contents, exclusive newsletters…

Already have an account ? Please log in.

[/vc_cta][vc_column_text]Featured photo : © Omega Watches[/vc_column_text][/vc_column][/vc_row]