The head of the Only The Brave group (Diesel, Maison Margiela, Marni and Jil Sander) has announced the probable postponement of his IPO to 2026. The reason: a sluggish start to 2024…

Chi va piano va sano (who goes slowly goes healthily)…

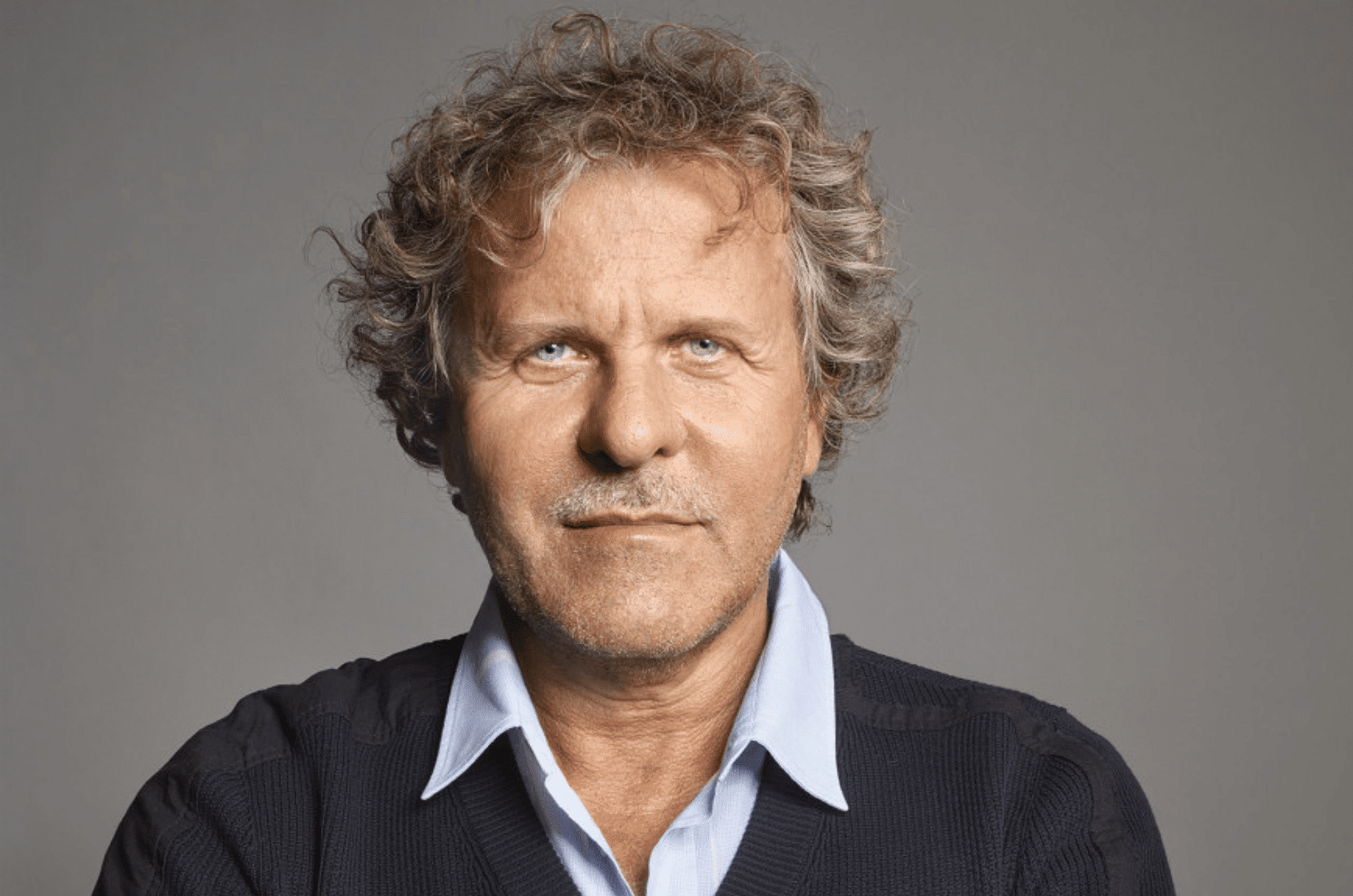

Renzo Rosso, Chairman of Italian fashion and luxury group Only The Brave (OTB), owner of Diesel, Maison Margiela, Marni and Jil Sander, seems to have adopted this adage for his IPO.

Despite OTB’s excellent performance in 2023, the CEO has made it known that this operation, initially planned for 2024 and then postponed until 2025, would probably not take place before 2026…

These “confidences” from Renzo Rosso were made at a fashion event in Rome on May 29.

“The beginning of the year has been a little quieter, which means it would be better to wait for the right moment, because when you take such a step, you want to do it with figures that are at the level investors expect,” Renzo Rosso thus admitted.

Slowdown in the first quarter of 2024

While OTB’s figures for the first quarter of 2024 are not known, there’s every reason to believe that its pace has slowed after the strong fiscal year of 2023.

Last year, the Italian group’s sales, driven by Asia, its own network and its two flagship brands (Diesel and Maison Margiela), rose by 10% at constant exchange rates to 1.9 billion euros, with a profitability of 19.6% on net sales.

In April 2023, when his IPO and possible acquisitions were being considered, Renzo Rosso admitted at the time that he was “not certain that anything will happen between now and the end of the year. When you do your due diligence, you never know what to expect”.

IPO postponed to 2025

Last October, Renzo Rosso postponed the IPO to 2025.

However, in view of the first half of 2024, he has decided to be even more cautious.

In fact, OTB now seems to be one of those luxury players that has underperformed since the beginning of the year.

In contrast to Hermès, Moncler, Prada and Brunello Cucinelli, all of which did very well in the first quarter of 2024, others, in particular Kering and its flagship Gucci, which was dragged down by the Chinese market, have been dragging their feet.

Tod’s also suffered in the first quarter of 2024, weighed down by poor shoe sales on the one hand, and in China on the other…

Escaping stock market pressure

Sales of the group, which owns the eponymous moccasin brand, Roger Vivier and Hogan shoes and Fay clothing, fell by almost 5% at constant exchange rates to 258 million euros.

These underperformances were the latest to be announced by the group headed by Diego Della Valle. In mid-May, the company was delisted from the Milan Stock Exchange following a successful takeover bid by L Catterton, the private equity group backed by LVMH. “We made this choice in order to develop the full potential of our individual brands, making all the necessary investments within a timeframe that we deem most appropriate”, stressed Diego Della Valle at the time, who remains the group’s majority shareholder along with his family.

Perhaps this reasoning convinced his compatriot Renzo Rosso not to rush into action himself, but to wait until he felt better before facing up to investor pressure?

Whatever the case, OTB is clearly in no hurry to be listed on the stock market…

Read also > OTB GROUP PERFORMED WELL IN 2023

Featured Photo: © OTB