Bogart, the French beauty specialist, is looking forward to continuing its expansion in Europe after a successful year in 2021.

Last year, the family-owned group achieved a turnover of 245.9 million euros, up 10% at current exchange rates.

And this despite a year 2021 “still disrupted by the health context and administrative closures”. Its two divisions are growing: the group owns 9 perfume and cosmetics brands (Carven, Bogart, Ted Lapidus, Neo Cologne, April, Méthode Jeanne Piaubert, Stendhal, Close……) or under licence (Chevignon…) and a network of own shops under the April banner.

The net result, share of Bogart, which integrated 38 Nocibé shops last October, did indeed contract sharply (-68%) to 0.7 million euros. But its Ebitda itself grew by +4.1% to 38.4 million euros. And its financial situation, “very healthy and solid And its financial situation, “very healthy and solid”, with a still high level of cash (93.2 million euros at the end of 2021 compared to 88.3 million euros a year earlier), allows it to remain “attentive to opportunities in 2022 to continue to develop its market share in Europe”. Its cash flow was €32.6m at the end of 2021 compared to €34.7m at the end of 2020.

In 2022, the group has already made its move: in January, it acquired Fann, the leading Slovakian selective beauty retailer, with its 68 points of sale. This will further expand its own portfolio of more than 400 April-branded selective perfumeries worldwide (Belgium, Luxembourg, Germany, France, Israel and Dubai).

Last year, the acquisition of Nocibé shops enabled Bogart to more than double its French network to around 70 outlets. Prior to that, Bogart had already acquired the German group HC Parfümerie and its network of 87 shops (in 2016), Distriplus, the leading retailer in Belgium with a network of 200 outlets (2018), and 18 selective perfumeries in Luxembourg belonging to the Milady Parfumerie network (2019).

The sounds of the boot in Eastern Europe do not disturb Bogart’s dynamics and ambition. The group announces a “favorable start to the 2022 financial year”. And it explains that the impact of the Russian-Ukrainian conflict is “very low” at the group level, as this zone only accounts for 0.6% of its consolidated turnover. Bogart also has “no industrial or commercial presence in these geographical areas”.

Read also > WHAT IS THE IMPACT OF THE WAR IN UKRAINE ON LUXURY COSMETICS BRANDS ?

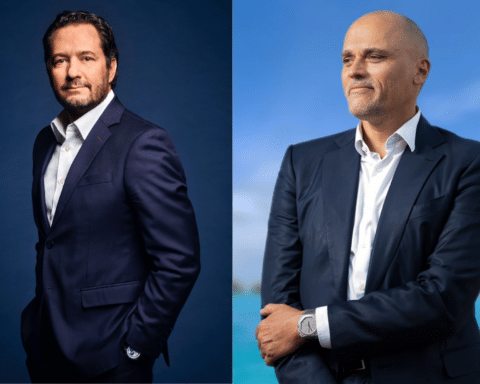

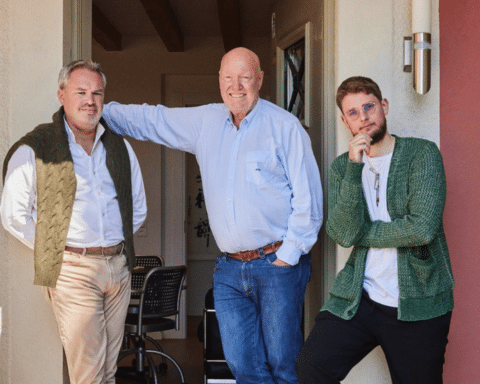

Featured photos : © April