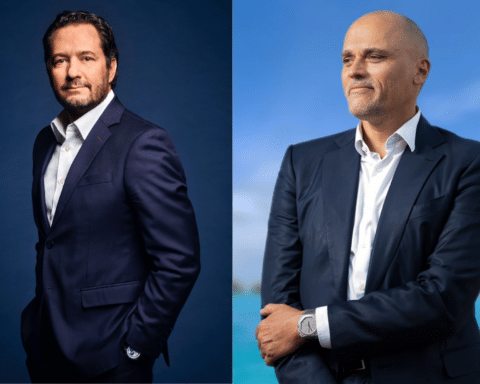

Last Friday, two European industrial heavyweights, Ferrari and Saint-Gobain, were announced as the next members of the Euro Stoxx 50 index, marking a significant milestone for these companies.

Italian luxury sports car manufacturer Ferrari, which has seen its market value increase sevenfold since its IPO in 2015, is set to join the Euro Stoxx 5, placing it in Europe’s most liquid index. This inclusion is the result of the company’s impressive growth in recent years, thanks to faster-than-expected deliveries and a strong order book.

Saint-Gobain, the building materials specialist, is also set to follow suit after an excellent first half.

They will join the Euro Stoxx index at the opening of trading on September 18, replacing German real estate company Vonovia and Irish group CRH in the index, according to the announcement made by index provider Qontigo, a subsidiary of Deutsche Börse responsible for the composition of pan-European indices.

Share price up

On the Milan Stock Exchange, Ferrari’s share price has risen by 42% since the start of the year, with investors enthusiastic about the faster-than-expected increase in deliveries and the strength of the order book. According to data compiled by FactSet, the group with the famous prancing horse is expected to achieve exceptional performance in 2023, both in terms of sales and net profit, setting records in the process.

As for Saint-Gobain, its share price has grown by almost 50% over the past twelve months. This rise has been underpinned by results exceeding analysts’ expectations in the first half of this year, as well as by an increase in the operating margin target for the current year, despite a difficult economic context. While Saint-Gobain has been a member of the CAC 40 since its creation in December 1987, this inclusion in the Euro Stoxx 50 further strengthens its presence in the leading indices.

Read also>AUTOMOTIVE: FERRARI AND LAMBORGHINI RECORD SALES

Featured photo : ©Press