De Beers has announced that it is suspending the manufacture of synthetic diamonds under the Lightbox brand. With the price of synthetic diamonds having fallen sharply, and the price of mined stones following suit, the South African diamond manufacturer is now focusing its strategy on natural diamonds.

“Diamonds are forever” has long been De Beers’ motto.

However, its strategy of manufacturing laboratory stones for jewelry will not have lasted more than six years.

While its owner, commodities giant Anglo American, is restructuring and looking to sell the company, mining company De Beers is to suspend Lightbox’s jewelry business.

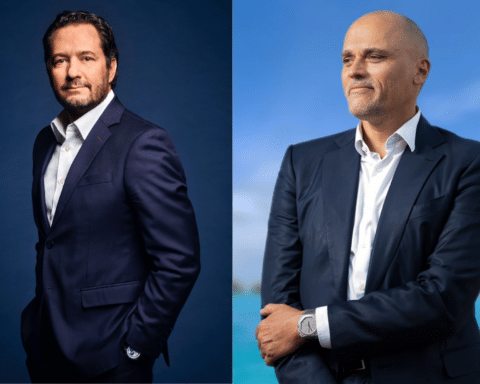

Al Cook, CEO of the South African diamond specialist, took advantage of the JCK jewelry trade show in Las Vegas to announce the discontinuation of the manufacture of synthetic stones for its Lightbox jewelry brand, at its plant in Gresham, Oregon. This activity will continue, but will be reoriented towards the production of industrial and technological diamonds.

New industrial targets

In an interview with National Jeweler, Al Cook explained that “the drop in the price of synthetic diamonds opens the door to amazing technological activities (…) A number of high-tech companies are looking at how to use diamonds as components in the digital age. For us, this is the future of synthetic diamonds”.

I

In 2018, De Beers threw a spanner in the works with the launch of its Lightbox jewelry brand, using laboratory-grown diamonds. The company had developed a multi-channel offering, ranging from loose or entry-level stones to more imposing and expensive ones, or forged collaborations with jewelry partners. It had also tried to sell synthetic diamond engagement rings, before withdrawing in the face of the scandal…

Falling prices

Yes, but… Whereas at the time of the launch of these synthetic stones, the fixed price per carat was 800 dollars, today it’s down to 500 dollars. And the wholesale price of diamonds grown in laboratories by the company’s competitors is now below Lightbox’s, even though they were the most competitive at the time!

In a double whammy, labels for natural diamonds, De Beers’ core business, have also fallen. According to Fortune, “the natural stones used in less expensive 1 to 2-carat wedding rings have plummeted under the pressure of synthetic diamonds and have so far shown little sign of a sustainable recovery”.

Indeed, the competition from laboratory diamonds is particularly formidable. Unlike some imitation stones, their highly sophisticated manufacturing process makes it impossible for experts to distinguish them from a diamond mined by the naked eye and without machinery.

Stock depletion

De Beers will continue to sell its Lightbox stones for around a year, until stocks run out, before deciding on the brand’s fate.

The production of laboratory diamonds for industrial applications will be continued by another De Beers subsidiary, Element Six, already dedicated to this activity. Aiming for the title of “leader in synthetic diamond technology solutions”, it will merge its three current production centers into a single world-class facility based in Portland, Oregon.

At the same time, de Beers will focus on restoring the lustre of its original natural diamond business, through its new Origins strategy and partnerships with two major diamond retailers, American Signet and Chinese Chow Tai Fook. De Beers will also introduce Diamond Proof, a new instrument for detecting laboratory-grown diamonds in-store.

Putting mined diamonds back at the heart of storytelling

“We really think we need to do a better job of telling the story of where natural diamonds come from and why they’re so special,” Al Cook told Business of Fashion.

While the supply of natural diamonds now exceeds demand, De Beers, which accounts for a third of the world’s diamond production, reduced its output by 23% in the first quarter of 2024, to 6.9 million carats.

Laboratory-produced synthetic stones account for between 25% and 35% of diamond volumes.

In 2023, De Beers had a disappointing year, with profits limited to 72 billion euros, compared with previous years’ figures ranging from 500 million to 1.5 billion dollars.

With its new strategy, the diamond manufacturer hopes to achieve a basic annual profit of $1.5 billion by 2028…

Read also > DE BEERS COULD BE FLOATED ON THE STOCK EXCHANGE

Featured Photo: © De Beers