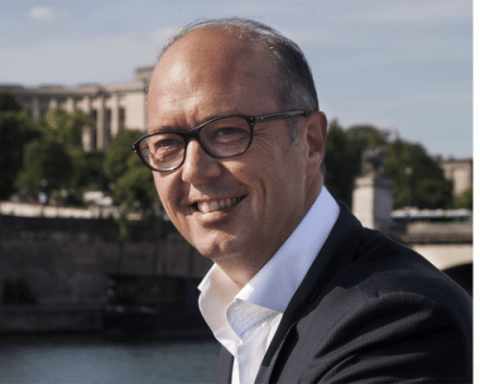

After fourteen years in the capital of Carrefour, the CEO of the world’s leading luxury goods company LVMH Bernard Arnault announced on 31 August that he was selling his stake in the group.

Bernard Arnault became a shareholder in Carrefour in 2007 via the holding company of the Agache group, alongside the Colony fund. Bernard Arnault held 5.7%, raising around €724 million by selling shares on the market as part of an accelerated bookbuilding process.

However, in the year following Arnault’s entry as a shareholder, Carrefour had a dismal annual performance of -48.4%.

The stake of his financial holding company Agache was sold at €16 per share, after the CEO, alongside Colony Capital and Axon Capital, had taken an initial 9.8% stake in 2007, at an average price of €47 per share.

In 2020, Bernard Arnault had started to sell part of his stake in Carrefour. Indeed, the supermarket chain’s share price had fallen by 5% during the initial trading.

The exact terms of the exit from Carrefour are expected to be clarified by the end of the week, when the transaction will be closed by accelerated bookbuilding.

Nevertheless, Carrefour’s current CEO Alexandre Bompard stressed the unwavering support of the French luxury group’s boss. “Agache has accompanied the history of the Carrefour group consistently for 14 years. Since my arrival, I have been able to count on Bernard Arnault’s unfailing trust and support at every stage of the group’s transformation. I would like to thank him very personally for this,” said Bompard.

Bernard Arnault had supported Alexandre Bompard in January, during the proposed takeover of the Canadian group Couche-Tard, with an offer of 20 billion dollars. This did not happen in the end, as the Canadian group was opposed by the French government.

“After 14 years of supporting Carrefour as a long-term shareholder, we have decided to continue to refocus our investments. With a high quality management team and recognised family shareholders, Carrefour has all the assets to amplify its renewal”, explained Bernard Arnault.

The Agache holding wishes to focus more on investments in the fashion and luxury sector. Last February, Agache acquired a stake in the German sandal brand, Birkenstock.

Read also > LVMH BRINGS VENICE TO SAINT TROPEZ

Featured photo : © LVMH